2024 Sustainability Report: Our Commitment to ESG

Our Mission

At MiddleGround Capital, our commitment to environmental, social, and governance (ESG) principles is at the core of our business model and the forefront of our operations. From initial screening and due diligence to ownership and exit, our commitment to ESG is ingrained in every stage of our investment process.

In the last twelve months, we’ve expanded our ESG initiatives and witnessed tangible improvements across our portfolio, including reducing our carbon footprint, workplace safety improvements, and increased employee engagement.

As we move forward, we are dedicated to responsible investing and setting high standards for ourselves and our portfolio companies.

Key Initiatives and Achievements

Environmental Impact

In 2023, we partnered with Gravity Climate to measure 100% of our portfolio’s carbon footprint (including Scope 1 and 2 emissions) and develop actionable decarbonization plans across our portfolio. With Gravity’s guidance, Race Winning Brands implemented several key projects at their sites, including furnace insulation, switching to LED lighting, and initiating waste heat recovery, which reduced natural gas consumption by at least 5%.

In another initiative, Lindsay Precast implemented CarbonCure Technologies, which injects captured carbon during the concrete mixing process. This resulted in a 6% reduction in cement content and a decrease of nearly 30 tCO2e in carbon emissions at a single facility during the first quarter of implementation.

Additionally, six new locations across our portfolio achieved ISO 14001 certification in 2023, demonstrating our commitment to improving our environmental performance and reducing our environmental footprint.

Social Responsibility

Employee well-being is at the heart of everything we do. We continued to offer 100% employer-paid healthcare including zero copays on health services as well as a comprehensive dental and vision benefits package, access to an onsite gym, generous parental leave, a competitive 401(k) retirement plan, and tuition reimbursement for continuous education. We aim for MiddleGround Capital employees to have access to ALL the care they need.

The implementation of our Level Up Safety program has driven significant safety improvements across our portfolio. In 2023, we conducted thorough safety assessments at over 80 portfolio locations with over 1,200 findings identified and corrected. By utilizing this program at Arrow Tru-Line, the team saw a reduction in their Total Recordable Injury Rate (TRIR) of over 50% year over year.

Significant progress was made in our commitment to community engagement and philanthropy. We established the MiddleGround Charitable Foundation, committed to supporting 501(c)3 organizations through grant-making and community service activities. In total, MiddleGround employees donated $1,503,517 and contributed 1,559 volunteer hours to various causes.

Governance and Accountability

In 2023, we aligned our newest funds with the EU Sustainable Finance Disclosure Regulation (SFDR) Article 8, ensuring transparency and accountability in our investments. We also partnered with Malk Partners to launch comprehensive ESG training programs for all employees with plans for there to be refresher training offered annually. This initiative goes beyond initial onboarding, providing ongoing education on current ESG trends in private equity, MiddleGround’s specific ESG policy and processes, regulatory requirements, ESG considerations during diligence, ESG integration in day-to-day portfolio activities, and common issues seen across the portfolio.

Across our portfolio, we’ve established ESG Committees on all Boards of Directors and implemented robust governance structures. Our portfolio companies have achieved an average board diversity of 23%.

Fair compensation is another area that remains a key focus. With increased hourly wages across our portfolio, intending to raise base wages to $25/hour by 2025, and improved employee engagement programs, we’ve seen positive retention results. At Arrow Tru-Line, we achieved a 42% decrease in employee turnover since its acquisition.

Looking Ahead

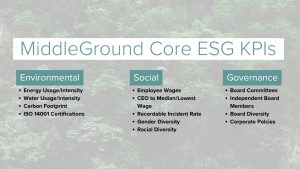

Moving forward, our focus is on building momentum and driving even greater positive change. A key component of our strategy is the implementation of Portfolio Investment 5-year plans, which include an ESG playbook with over 300 initiatives that portfolio companies can utilize to achieve their ESG goals. We will continue to track key performance indicators (KPIs) to help us measure progress and identify areas for improvement.

Our firm believes that responsible investing and sustainable business practices are essential for long-term success. As we look to the future, our vision remains clear: to continue building on the strong foundation we’ve built while setting new benchmarks for excellence in ESG.